Background

This is the first of many posts where I lay out my fundamental thesis for altcoins. Investing in these altcoins coins is riskier than $BTC and $ETH as they have higher betas, but the upside is enormous. The return profile is similar to VC who investing in tech startups: most of the projects go bust, but a few of the winners can pay for all the losers and more. Unlike in traditional startups who adjusts valuations between rounds, crypto altcoins have constant price feedback, creating a lot of volatility especially at the lower market caps.

Altcoins

The altcoins can be split into various sections similar to how MSCI splits up the S&P 500 into 11 different sub-sectors like financials, energy, and utilities. Looking through the top projects, there are a few groupings that jump out:

- Layer 1's ($ETH, $DOT, $ADA, $SOL)

- Stable Coins ($USDT, $USDC, $DAI, $SUSD)

- Exchange Coins ($BNB, $FTT, $KCS)

- Privacy Coins ($XMR, $ZEC, $\SCRT, $PRIV)

- DeFi ($LINK, $UNI, $AAVE, $SNX)

FTX

In this article, I focus on $FTT, the native token for the cryptocurrency exchange FTX . FTX is one of the top cryptocurrency exchanges by trading volume with lots of innovative features that make it stand out:

- They were the first exchange to create 3x and -3x levered tokens12.

- Tokenized stock trading including pre-ipo stocks which trade 24/7. FTX participates in the IPO process of certain companies and receive shares from underwriters. They then use those shares to create markets before official IPO date. 3

- They are often the first exchange to list new tokens. Examples include $USDT and $SUSHI futures.

- Consistently have quality IEOs (initial exchange listings). Like IPOs in the traditional market or ICOs from 2017, nowdays many protocols directly list on exchanges. FTX vets these protocols and allows exposure from day one.

- There is a world class risk management system with minimal claw-backs, unlike some of their competitors. This allows them to capture more volume in times of high volatility.

$FTT

In summer 2019, FTX launched their exchange token $FTT which provides trading discounts and other airdrops to holders of the token. Staking $FTT tokens can give maker rebates up to .3 bps and FTX is one of the few large exchanges with maker rebates often leading to deeper liquidity on the exchange. In addition there are weekly buyback and burns of the tokens until half of the supply is destroyed. These burns equate to

- 33% of all fees generated from the exchange

- 10% of net additions to the insurance fund

- 5% of fees from other uses of the platform

ICO

There were 3 ICO rounds which sold a total of 59.3 million $FTT tokens sold. The breakdowns are as follows:

- 50 million tokens between $0.1 and $0.2. These linearly vest over first 3 months.

- 6.5 million tokens between $0.2 and $0.6. These linearly vest over first 1.5 months.

- 2.8 million tokens between $0.6 and $0.8. These linearly vest over first month.

Token Emission and Vesting Schedule

There is a 350 million supply cap of $FTT according the the whitepaper4. Currently there are around 100 million $FTT circulating, so it is important to learn the emission schedule as a lot of these tokens could be coming on the market creating dilution and sell pressure. Apart from the ICO tokens described above, there are around 115 million tokens to be sold for future rounds and 175 million tokens for other tasks like insurance fund insurance, safety fund, liquidity fund, and team tokens. These are all locked up over 3 years with a linear vesting schedule.

Circulating Supply

Here is the genesis wallet which held 350 million $FTT. Since then, 273 million has exited leaving the wallet with 77 million $FTT. Those 77 million tokens are presumably part of the 115 million tokens to be sold for future rounds. On Crunchbase, we can see that FTX raised two additional rounds, in December 2019 and March 2020. I believe that 38 million tokens were sold already with a three year daily unlock. Another large wallet has over 170 million $FTT and it is the companies wallet. This leaves a total of around 100 million circulating tokens.

Inflation and Deflation Modeling

Weekly Unlocks

On the transparency page, there is a link to the breakdown of team tokens. The team has around 31.25 million tokens locked over 3 years translating to about 200k tokens unlocked a week. The other two rounds of investors who sold on Crunchbase have around 38 million tokens locked over 3 years translating to about 240k tokens unlocked per week. Summing those two together, there are around 440k tokens unlocked each week.

Token Burns

The opposite of the inflation schedule is the weekly token burn. At the time of this article, there have been almost 10 million tokens burned which equates to around 100 million dollars. The best proxy for the tokens burned is trading volume and we can create a model predicting the amount of tokens burned to the volume traded. Around 100k-200k tokens were burned per week in 2020, so this would lead to anywhere from 200k-300k new tokens introduced per week or around 10 million to 15 million per year akin to 10% to 15% of the circulating supply.

Pricing

One of the more fundamental ways to see if the price of a specific cryptocurrency will go up is to look at the supply increase and see if the underlying fundamentals will increase more or less than the specific supply. We see that there will be 10-15% of token dilution so we should see if the fundamental metrics will increase more of less than this number as this would keep some of the fundamental ratios in line. For example, if we were valuing the company like a traditional stock on P/E ratio in order for the price to go up over the 10-15% dilution, the earnings must also go up 10-15%. This leads us to the next section which we can project the fundamentals of FTX which is again (inherentely) how much volume will trade on FTX.

Crypto Volume

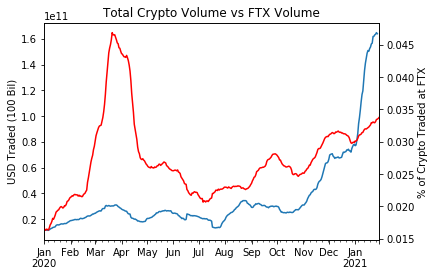

At the heart of the future valuation is the projected future volume. Cryptocurrencies are a growing industry and volume have slowly increased throughout the years. The exchange pie is getting bigger and FTX is being a larger player relative to other exchanges. Below we a picture of aggregated futures crypto traded volume from 2020. Specifically the blue line is the volume traded5, which went from around $20 billion a day to the current $160 billion a day an 8x increase in a year. In addition, the red line is the plot of futures volume6 traded on FTX. This started at 2\% and has since gone up to close to 4\% of total derivatives volume 7. I expect both the volume of crypto currencies traded and the percent traded on FTX to continue to increase in the foreseeable future.

So this past year FTX almost doubled its volume in relation to its peers and crypto itself did an 8x in volume. If 2021 is even remotely close to 2020, $FTT is extremely undervalued.

Conclusion

FTX has consistently made strides to capture the most crypto volume. In August 2020, FTX bought Blockfolio, one of the leading portfolio tracking apps with over 6 million users at the time of purchase. Then just yesterday, on the heels of Robinhood and other US brokerages limiting stock trading in select names, Blockfolio adds zero fee stock and crypto trading.

With innovative features along with a history of growth, I believe that FTX will continue on its path to becoming the largest exchanges in the world. I own $FTT both as a beta play on crypto exchange volume increasing as well as an alpha play on FTX continuing to eat market share from other participants. The pie is growing and the share of the pie is growing.

- This is similar to the levered ETFs in traditional finance. ↩

- These have the advantage of having fixed borrow compared to futures and there are no liquidations on the levered tokens. ↩

- Airbnb was the first pre-IPO market and Coinbase is the second. These provide a unique way to get exposure to an unlisted but popular stock. ↩

- Etherscan says there is 340 million but I will lean on the whitepaper number. ↩

- Rolling 30 days ↩

- Also rolling 30 days ↩

- The reason why there is the spike in February and March is because that time was very high volatility and FTX was one of the exchanges that was still functioning properly with the least amount of clawbacks. ↩